With global environmental concern, the World Economic Forum (2021) reported that fashion is responsible for about 5% of global emissions and, together with Fast Moving Consumer Goods, it is the third most polluting industry, after construction (10%) and food (25%). That’s why luxury and even fast fashion sustainability and environmentally friendly practices are now so crucial.

Nevertheless, fashion was born to allow people to express their style rather than produce waste. In brief, fashion moved its first steps as an ethical business driven by craftsmanship and slow movement as values that the luxury business stands for.

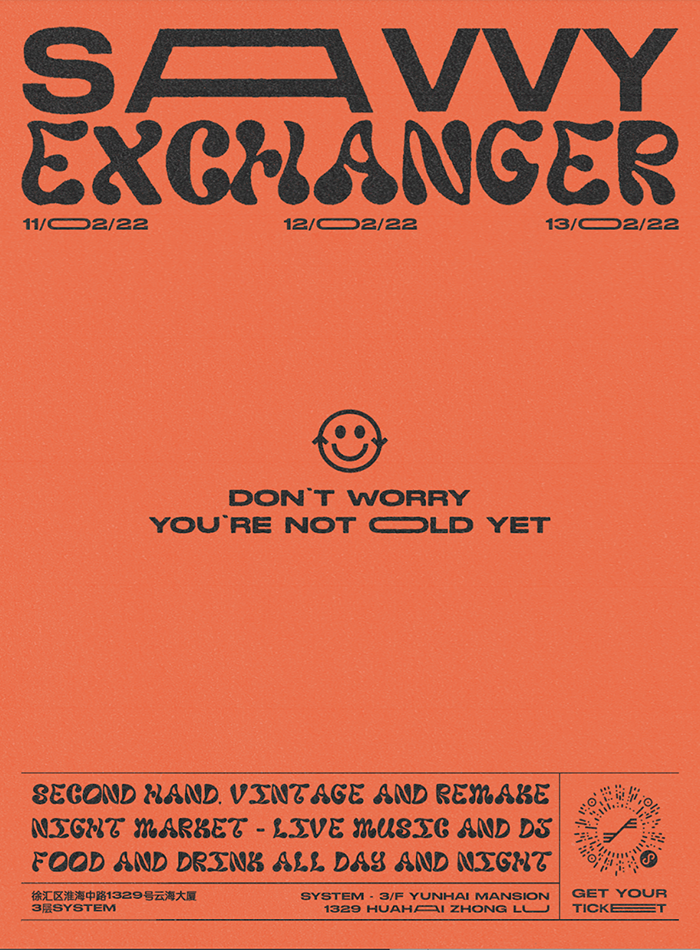

Polaroids from a second-hand swap n' shop event organised by the go-green lifestyle community Savvy Exchanger in China

No doubt, we are facing a short circuit. Even if “Will the fashion industry ever be sustainable?” seems to be an impossible question to answer, there are so many ways fashion can be greener. Moreover, increasing worldwide consciousness is driving companies to adjust their environmental policies, do their best to make ethical and eco-friendly clothing and say goodbye to lousy pollution practices.

Who invented circular fashion

Dr Anna Brismar, owner and founder of the consultancy Green Strategy, coined the term “Circular fashion” in June 2014 when planning a sustainable fashion event in Stockholm (this event was later named “Circular Fashion – Show & Talk 2014”). So, what is a circular brand and how do you make fashion circular? As defined by Brismar, the concept of “circular fashion” is based on:

- Quality and timeless design;

- Use of sustainable and environment-friendly fabrics and materials;

- Adoption of renewable energy and reduction of energy consumption in production, transport, supply chain and marketing;

- Connecting multiple users with the second-hand market and sharing economy;

- Recycling and upcycling.

As you can see, the luxury resale and pre-owned market are at the very bottom of the list, as the element that comes full circle: it’s all about reusing second-hand products by generating a new life story for them.

Is there a resale market for China?

A leading second-hand luxury sales platform, the Paris-based Vestiaire Collective has gained a substantial market footprint in Europe over the past few years. Today, the company is in the process of building a tech hub in Shanghai to better service the fast-growing Asia Pacific market and China itself.

As Vestiaire’s APAC Chief Growth Officer Baptiste Le Gal told BoF-Business of Fashion, this area “will grow to become one of the most sophisticated markets for second-hand shopping”. If you’re wondering what the Chinese like to buy today, the answer is probably “vintage”.

A second-hand swap n' shop event by Savvy Exchanger in China

Le Gal’s quote is interesting for a few reasons. One of them is that in 2017 fashion business students at Istituto Marangoni in Paris conducted research to understand the perception of luxury resale from consumers’ perspective. Students were divided into three groups by geographic areas: France, Italy and China. The research showed that the French were more willing to sell and purchase vintage luxury goods, while Italians thought that they were a heritage to pass on from generation to generation. Otherwise, Chinese consumers thought that luxury was synonymous with social status and preferred to buy new garments and accessories rather than pre-owned clothes. Most Chinese respondents also said they were afraid of counterfeit products as a potential risk in vintage shopping.

Of course, five years later, the attitude of China’s younger generation has radically changed. iResearch reported that China’s domestic luxury resale market was valued at 51 billion yuan ($8 billion) in 2020 and forecasted that its total value would grow fourfold to 208 billion yuan ($32.75 billion) by 2025.

So, the development of China’s e-commerce infrastructure and its live-streaming ecosystem are working to help the industry thrive rapidly. This said, the majority of international resale platforms have yet to join the increasingly crowded and competitive resale arena in China, but opportunities are many, as Vestiaire’s plans well show.

Not to mention that over the last two years, even local Chinese platforms such as Xianyu, Zhier, Feiyu, Xinshang, and even offline store Aloha have all built a significant network of loyal customers and B2B buyers.

How China's resale segment is expected to win consumer trust

In response to concerns about counterfeits, training courses to identify the differences between real and fake products are becoming increasingly popular. The market price of a seven-day specialist training programme is around RMB 21500 ($3,500) in Shanghai, and training organisations can recruit 50 to 60 trainees per class, reflecting growing market needs.

What is Savvy Exchanger, the booming phenomenon of offline exchange markets, and how sustainable fashion is catching on in China

First of all, let’s introduce Savvy Exchanger. As a go-green lifestyle community, they host second-hand swap n’ shop events paired with street food vendors, live music, styling workshops, photo sessions, and much more. Their events have provided people with sustainable, waste-free consumer options since 2019, so they have also become the place to be for young fashionistas to exchange their pre-loved goods.

Poster for one of Savvy Exchanger latest events in Shanghai

According to Savvy Exchanger founders Giulio D’Alessio and Sivona Lu, their initial idea was for people to swap clothes they no longer wore. But in less than two years, it has turned into a monthly marketplace with over 4000 customers per event. In one of the most successful offline exchange markets, in August 2021, they achieved a total turnover of $70,000 in three days.

“People came to exchange swaps they no longer used and received something from others. It really worked!” explained Sivona Lu. She also added, “Then we thought: why not make the impact more powerful? Not only to exchange but also to sell and buy. In the end, some customers of second-hand luxury products came back as sellers to influence more people.”

Moments during a Savvy Exchanger event in Shanghai

According to Giulio D’Alessio, who also works as creative director and tutor at Istituto Marangoni Shanghai, “The luxury resale market has just started in China. It is not the same situation as in Italy, where you can easily find many vintage sellers. Chinese ones are mostly young fashion lovers who started collecting not so long ago. So, this market has a huge potential.”

Sometimes, Savvy Exchanger had some goods donated by customers, which they donated to charity or to fashion schools to allow students to design and develop upcycling projects.

Upcycling dress (courtesy of Qu Zhixuan, Alumnus in Fashion Design & Styling Intensive One-Year programme)

Luxury insights showed in their recent report that Chanel vintage necklaces are selling for up to 697% of their retail value. Thanks to the digitisation and awareness of sustainability and circularity, the luxury resale market has gained popularity not only across geographies but also across demographics.

So, the Chinese fashion and luxury market have changed significantly with the rise of the younger generations: most Gen Z-ers and Millennials would not purchase if they did not consider it sustainable. Because it is a sustainable business, luxury resale is entering a new era in China.

Yingting Cheng

Chief Operating Officer, Shanghai